Where the techniques of Maths

are explained in simple terms.

Financial Maths - Series - Annuities - Investment goal and required contribution.

Test Yourself 1 - Solutions.

- Algebra & Number

- Calculus

- Financial Maths

- Functions & Quadratics

- Geometry

- Measurement

- Networks & Graphs

- Probability & Statistics

- Trigonometry

- Maths & beyond

- Index

| Determining a total investment amount. | 1. Rate per half year is 5.5% = 0.055

End of 1st half = 2000×1.055. End of 2nd half = (2000×1.055 + 2000)×1.055 End of 3rd half = (2000×1.055 + 2000)×1.055 + 2000)×1.055 = 1.055 × 2000 × (1 + 1.055 + 1.0552) End of 37 years (the day after - on her birthday) she would have made another deposit. So 74 deposits. Total = 1.055 × 2000 × = $1,978,152.86 |

| 2. Rate at 8% p.a. = 2% per quarter = 0.02. n = 10 × 4 = 40. End of Quarter 1 = $500. End of Q2 = 500 × 1.002 + 500 End Q3 = (500 × 1.002 + 500) × 1,002 + 500 = 500 × (1 + 1.02 + 1.022) So end Q40 = 500 × |

|

| 3. 10% p.a. = 0.00833 p.m.

End M1 = 200 × 1.00833 End M2 = (200 × 1.00833 + 200)×1.00833 End M3 = [(200 × 1.00833 + 200)×1.00833 + 200] × 1.00833 = 1.00833 × 200 (1 + 1.00833 + 1.008332) End M12×20 |

|

4.  |

|

| Finding the required contribution. | 5. End A2:

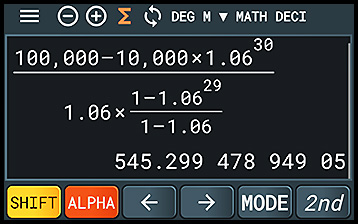

(10,000 × 1.06 + M)1.06 = 10,000 × 1.062 + M×1.06 (iii) End A3 = [10,000 × 1.062 + M×1.06 + M]1.06 = 10,000 × 1.063 + M×1.06(1 + 1.06) (iv) Note that the 1.06 in the 1st term has an index of 3 - the same as for the year number. There are however only two terms in the brackets - one less than the number of years (as the first annual deposit occurred in the second year). So at the end of year 30:

(v) Contribution = $10,000 + 29 × $545 = $25,805. |

| 6. As the end of 2020 represents the end of Year 1, the end of 2030 represents the end of Year 11 (NOT 10).

(i) End Y1, Mimi has 5000 (deposited in January 2020) × 1.09 for her interest for the year. End Y2 = (5000 × 1.09 + 5000) × 1.09 End Y3 = [(5000 × 1.09 + 5000) × 1.09 + 5000] × 1.09 = 1.09 × 5000 [1 + 1.09 + 1.092] ∴ End Y11 (i.e. 2030) (Note the number of years saving is 11 NOT 10!!! Count it on your fingers.) (ii) Mimi has $95,703.60 + $5000 = $100,700 (to nearest $10). (iii) After 31 years of saving, Mimi has $$815,184.93. Evie starts saving at the beginning of 2031 with a deposit of $D. We can use the same basis as for Mimi but rewritten as End Year 20 (be careful) =

So Mimi will have to make annual deposits of about $14,620. (iv) At the end of the 31 years, Mimi will have invested 31 × $5,000 which is $155,000. At the end of 20 years saving, Evie will have invested $292,366.80. So Evie spends $137,366.80 more than Mimi to reach the same savings goal. Implication: Start saving early and regularly even with small amounts. |

|

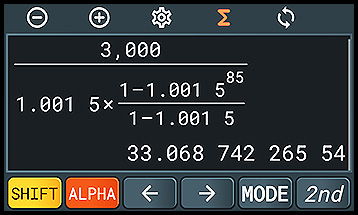

| 7. In 20 months there are about 86 fortnights. Be pessimistic and say 85. The interest rate of 4% p.a. converts to 0.0015 per fortnight (again rounding down to be pessimistic - its not good "To Always Look on the Bright Side of Life".

Let her required regular deposit (which she is trying to find) be $A Charlotte makes her first deposit of $A to implement her plan so 2 weeks later she is ready to continue. End F1 = A × 1.0015 End F2 = (A × 1.0015 + A) × 1.0015 End F3 = [(A × 1.0015 + A) × 1.005 + A] × 1.0015 = 1.0015 × A [1 + 1.0015 + 1.00152] End F85 = 1.0015 × A × and this amount must equal $3,000 for Charlotte's holiday. ∴ 1.0015 × A × Just divide both sides by the non-A terms on the left (you do not even have to rewrite - just put it into your calculator slowly and carefully).

So Charlotte needs to save $33 per fortnight to be able to afford her holiday. Probably she would aim at $35 - just to exceed her target with no real problem to her current expenditure. |

= $30,200.99

= $30,200.99